India Waste to Energy Market (2025-2033)

Only Excel

The Excel covers estimation with respect to the India Solar Energy Forecast and is Segmented by Technology (Thermal, Bio-chemical, and Other technologies), and Waste Type (Municipal solid waste, Process waste, Agricultural waste, and Other waste types). For Each Segment, the Market Sizing and Forecasts have been done based on Revenue (USD Million).

Historical Year: 2021-2023 | Base Year: 2024 | Forecast Year: 2025-2033

Market Overview

India generates massive amounts of waste daily, presenting a huge untapped energy potential. According to the Ministry of New and Renewable Energy (MNRE), the energy generation capacity from urban and industrial organic waste is estimated at 5,690 MW, signaling a massive growth opportunity for the WtE sector.

Key government initiatives driving market growth include:

Swachh Bharat Mission: Promoting waste segregation, recycling, and WtE adoption.

National Bio-Energy Mission: Offering financial incentives for WtE plant development.

15th Finance Commission Grants: Funding municipal solid waste management projects.

Notable WtE Projects in India

India has seen multiple large-scale WtE projects in recent years:

Mumbai’s 600 TPD WtE Plant (7 MW capacity, ₹5.04 billion investment).

Ahmedabad’s Piplaj Plant (15 MW, processing 1,000 metric tonnes/day).

Visakhapatnam’s Kapuluppada Facility (9.9 MW output).

These projects highlight India’s commitment to sustainable waste management and renewable energy generation.

Market Dynamics and Growth Prospects

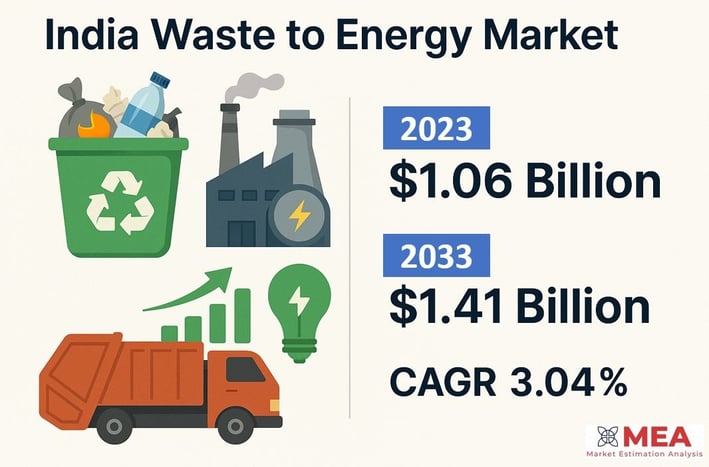

The India Waste to Energy market size reached US$1.06 Billion in 2023. MEA (Market Estimation Analysis) expects the market to reach US$1.41 Billion by 2033, exhibiting a growth rate (CAGR) of 3.04% during 2025-2033.

The India Waste to Energy (WtE) market is witnessing rapid expansion, fueled by rising urbanization, increasing waste generation, and government initiatives promoting clean energy solutions. As cities expand, the need for efficient waste management and sustainable energy production has made WtE a critical sector in India’s renewable energy landscape.

The Indian government is actively supporting WtE technologies through policies, incentives, and large-scale projects, aligning with its Swachh Bharat Mission and National Bio-Energy Mission. With biomethanation, pyrolysis, and thermal conversion technologies gaining traction, India is turning waste into a valuable energy resource, reducing landfill dependency, and cutting greenhouse gas emissions.

Key Market Trends Shaping the Industry

Rising Adoption of Biomethanation Technology

Biomethanation is gaining momentum due to its dual benefits—clean energy production and organic waste reduction. The MNRE has installed multiple biomethanation plants across India, including:

33,000 kg/day capacity in Punjab

10,200 kg/day in Karnataka

This technology minimizes toxic emissions and supports India’s sustainability goals.

Surge in Waste-to-Energy Projects

India is heavily investing in WtE projects to:

Reduce landfill waste

Generate renewable electricity

Lower carbon footprints

These initiatives are driving technological advancements and positioning India as a leader in sustainable waste management.

Growing Demand for Pyrolysis Technology

Pyrolysis is emerging as a game-changer in waste conversion, offering:

Decentralized waste processing

Lower pollution compared to traditional disposal

Production of bio-oil, syngas, and char

For instance, IIT Bhubaneswar developed a microwave pyrolysis reactor to convert plastic and mixed waste into energy efficiently.

Circular Economy Integration

WtE is evolving with circular economy principles, focusing on:

Waste minimization

Material recycling

Energy recovery from non-recyclable waste

Technologies like anaerobic digestion and plasma gasification are converting waste into electricity, heat, and biogas, while by-products like ash are repurposed for construction.

Segmentation and Market Insights

MEA provides an estimation of each segment of the India Waste to Energy market, along with forecasts at the country level from 2025-2033. Our excel has categorized the market based on technology, and waste type.

The India solar market is segmented by technology into thermal, bio-chemical, and other technologies. Additionally, it is segmented by waste type into municipal solid waste, process waste, agricultural waste, and other waste types.

Segmentation by Technology

Thermal Technologies: Leading the charge, thermal methods like incineration, pyrolysis, and gasification dominate India’s WtE market. These processes shrink waste volumes and recover energy efficiently, making them a go-to for urban waste management.

Bio-Chemical Technologies: Gaining momentum, bio-chemical solutions like anaerobic digestion turn organic waste into biogas and bio-fertilizers, thriving in rural and semi-urban settings.

Other Technologies: Niche options like bagasse cogeneration and palletization cater to specific industries, enhancing waste valorization diversity.

Segmentation by Waste Type

Municipal Solid Waste (MSW): Accounting for 150,761 tonnes daily (2019-20), MSW is a WtE powerhouse with a 1,247 MW potential, driving urban energy solutions.

Process Waste (Industrial Residues): Industrial byproducts from sectors like paper and dairy offer energy opportunities, cutting costs and emissions.

Agricultural Waste: Crop residues like rice straw fuel rural energy projects, curbing pollution from burning.

Other Waste Types: Specialized streams like medical and poultry waste demand tailored tech for safe, high-energy conversion.

Get Accurate Forecasts and Data

Our meticulously designed Excel sheet provides detailed forecasts and estimations for the India waste to energy market. With segmentation across technology, and waste type, our data enables businesses to identify opportunities, analyze trends, and strategize effectively in this dynamic market.

Competitive Landscape

India’s WtE market features global & domestic players investing in advanced technologies and strategic partnerships.

Key Companies:

Abellon Clean Energy (14.9 MW plant in Gujarat)

Jindal Urban Waste Management (Ahmedabad’s 15 MW plant)

Brihanmumbai Municipal Corporation (600 TPD Mumbai project)

Suez Group, Veolia, Hitachi Zosen (Global tech leaders)

Recent Developments:

Delhi Metro became India’s first project powered by WtE (Ghazipur plant).

Mergers & acquisitions are increasing as firms expand technological capabilities.

SEGMENTS COVERED

By Technology

Thermal

Bio-Chemical

Other Technologies

By Waste Type

Municipal Solid Waste

Process Waste

Agricultural Waste

Other Waste Types

Scope of the Market Estimation

Detail

2021-2033

2024

2025-2033

Value (USD Million)

Technology, and Waste Type

Metric

Market size available for years

Base Year Considered

Forecast period

Forecast units

Segments

Insights

Empowering businesses with data-driven market estimations.

© 2025. All rights reserved.

Links

Address

Jorhat, Assam, India

Post Office - 785015

Follow us

Registration Number: UDYAM-AS-15-0024368

We Accept

Opening hours

Monday - Friday: 10:00 IST- 19:00 IST

Saturday - Sunday: Closed